Understanding Closing Costs

In today’s fluctuating economy, Canadian homeowners are increasingly looking at refinancing their mortgages

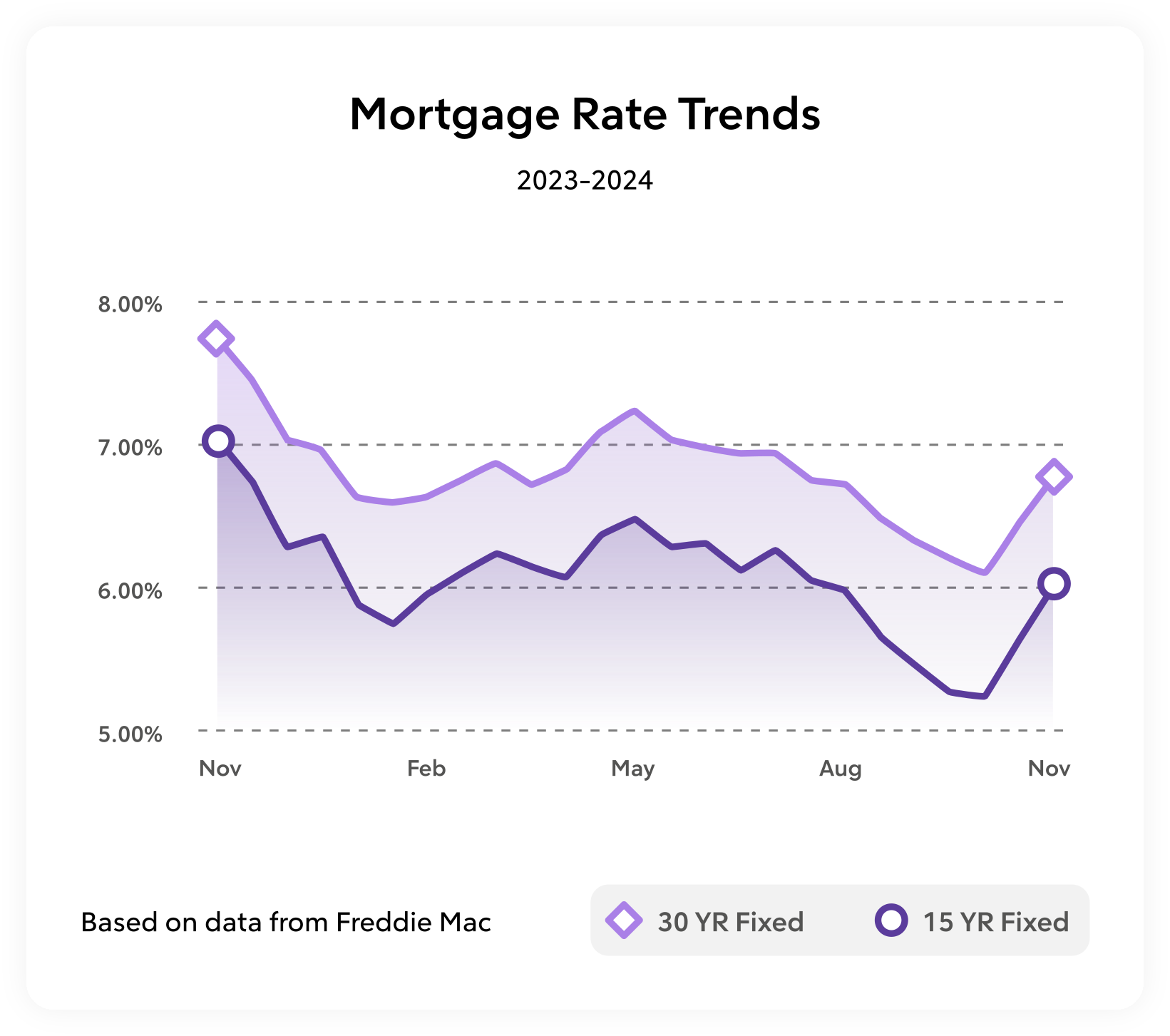

RATE UPDATES

Get the right mortgage rate with Simply Approved Mortgages, securing your mortgage rate has never been easier. Get started today!

Understanding mortgage rates is crucial for finding the best loan. Mortgage rates impact your monthly payments, the total cost of your loan, and your overall financial health. At Simply Approved Mortgages, we make it easy to compare rates across different loan types and terms so you can secure the best deal for your needs.

Unlike many lenders who charge 2%–2.75% in loan officer compensation, we keep our fees at just 1.5%, ensuring you save money from day one.

Mortgage rates are influenced by several factors, including:

Economic Trends

Federal Reserve Policies

Creditworthiness

Loan-to-Value Ratio (LTV)

Loan Term and Type

Disclaimer: Advertised rates and fees depend on borrower qualifications and market fluctuations.

While most lenders charge 2%–2.75% in loan officer compensation, we charge just 1.5%. Here’s what this means for you:

Example Savings:

Disclaimer: Advertised rates and fees depend on borrower qualifications and market fluctuations.

Learn more about adjustable and fixed-rate mortgages on our loan products page.

Disclaimer: Advertised rates and fees depend on borrower qualifications and market fluctuations.

Federal Housing Administration (FHA) loans are ideal for first-time homebuyers or those with lower credit scores.

At Simply Approved Mortgages, we operate with a 1.5% fee, significantly below the industry standard. This ensures more savings for borrowers without compromising service quality.

Disclaimer: Simply Approved Mortgages complies with all state and federal licensing requirements that we are licensed in.

VA loans are exclusive to veterans, active-duty service members, and eligible surviving spouses.

USDA loans are designed for buyers looking to purchase homes in rural or suburban areas.

Conventional loans are not backed by the government and typically require higher credit scores.

For high-value properties that exceed conforming loan limits, jumbo loans offer tailored financing.

Gather Documentation:

Get Pre-Approved:

Your Mortgage Journey Starts Here:

Close Your Loan:

At Simply Approved Mortgages, we offer a wide range of mortgage products tailored to meet your needs:

👉 Explore these options today and find the perfect mortgage solution for your needs!

With our industry-leading 1.5% fee, compared to the standard 2.75%, we save you thousands while offering competitive rates tailored to your needs. Learn More.

Our team of seasoned professionals is dedicated to simplifying the mortgage process, providing personalized solutions, and ensuring you feel confident every step of the way.

We prioritize honesty and clarity. From disclosing every detail upfront to ensuring no hidden surprises, we build trust through our commitment to your financial success.

Mortgage rates can change based on factors like loan type, market trends, and your personal financial profile. Understanding these variables is key to finding the best rate for you. Here are the current average rates for the most popular loan types in the U.S. to help you make an informed decision today.

We start by getting to know you – your goals, your needs, and your financial picture – to find the best mortgage solution.

Your goals – both now and in the future – will guide us in choosing the right path forward for your mortgage.

We'll help you choose the best option for you, with the right rate and monthly payment that fits your budget.

You pay upfront to get a lower rate on your mortgage. The cost? One point is 1% of your loan amount. The savings? A point lowers your interest rate by 0.25%

A temporary buydown reduces your rate for a specific period, giving you lower payments upfront.

Eligible buyers can receive credit toward their down payment or closing costs, helping to lower your monthly payment. Discover our affordable loan options today.

Homeowners are sitting on record-high home equity – and you can tap into it for cash. Explore your options today.

Life has changed since you first got your mortgage – see how a new mortgage could work better for you today.

Home equity is up, and rates are down. If it’s time to move, we’re here to help you buy, sell, and save.

Higher credit scores typically get lower rates because they predict you’re more likely to pay back your mortgage.

Lower debt predicts you’re more likely to be able to pay your mortgage. So a lower DTI can mean a lower interest rate.

The Federal Reserve, inflation and the housing market all influence mortgage rates.

Get a free credit score check to understand where you are and how to move forward.

Small changes in your credit score can lead to significant savings on your mortgage.

Stay on top of your credit health with credit monitoring, so you can catch issues early and maintain a strong score.

Discover how your credit score affects your mortgage options and rates. Plus, get personalized offers through our partner services to help you find the best loan for your financial situation.

Powered by our credit monitoring partner at Myfreescorenow.

No credit card is needed to sign up.

Remember that a good credit score can lower your interest rate on your mortgage.

Mortgage rates fluctuate daily based on economic factors, lender policies, and Federal Reserve decisions. Staying informed about current mortgage rates is essential for locking in the best deal on your home loan.

You can also get help from a Home Loan Expert.

The interest rate is the cost of borrowing money, while the APR (Annual Percentage Rate) includes additional fees, giving you a more accurate total cost of the loan.

Our 1.5% loan officer compensation is lower than the industry standard, allowing us to offer competitive rates and reduced costs.

Rates can change daily based on market conditions and lender pricing strategies.

Take control of your home-Take the guesswork out of your home-buying journey. Use our Mortgage Calculator to estimate your monthly payments and make informed financial decisions.

Start Now:

Simply input your details and see how much equity you could access today. If you have questions or need assistance, our team is here to guide you every step of the way.

In today’s fluctuating economy, Canadian homeowners are increasingly looking at refinancing their mortgages

In today’s fluctuating economy, Canadian homeowners are increasingly looking at refinancing their mortgages

In today’s fluctuating economy, Canadian homeowners are increasingly looking at refinancing their mortgages

Reduce your monthly payment or loan term while unlocking the full potential of your home’s equity!

Unlocking the American Dream, One Home at a Time

NMLS# 2620881 | NMLS Consumer Access Record